According to Comprehensive Research of Maximize Market Research, Ethanol Car Market is segmented by Fule Type (Gasoline, Diesel), by Vehicle Class (Hatchback, Sedan, SUV, Other), by Blend Type (E10 to E25, E25 to E85, Above E85) and by Drive Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive).

Ethanol Car Market Size:

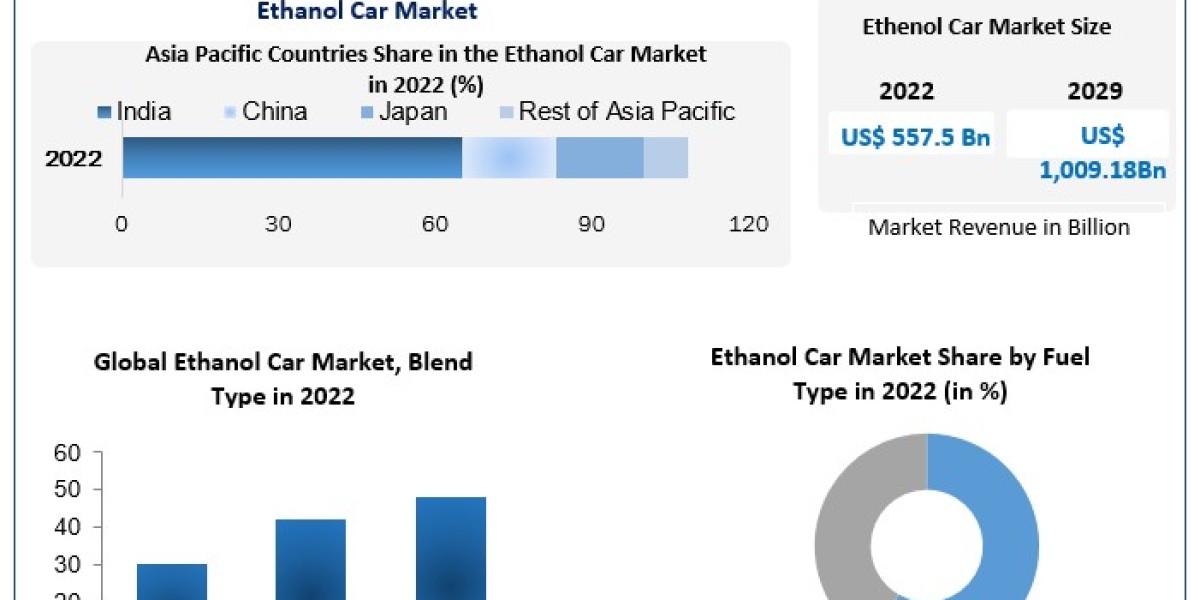

- In 2022, the Ethanol Car Market size reached USD 557.5 billion.

- Anticipated 7.7% growth from 2023 to 2029.

- Expected total revenue to reach nearly USD 1009.18 billion by 2029.

Research Methodology: Request Free Sample Report

Ethanol Car Market Report Scope:

- Comprehensive analysis of the global Ethanol Car Market.

- Focus on vehicle types, emission standards, and other automotive and fuel market aspects.

- Examination of the automobile markets in Japan, China, India, Mexico, South Korea, Canada, Indonesia, Brazil, and the US.

The segments covered in the Ethanol Car Market report are based on Type, Price Point, Distribution Channel, and Region.

The Ethanol Car Market is divided into two categories based on Fuel Type: Gasoline and Diesel. During the projection period, gasoline is anticipated to rule the ethanol vehicle market. The three primary varieties of ethanol-gasoline mixes are E10, E15, and E85. E10 is gasoline that has 10% ethanol in it. Compared to E15, which is gasoline with a 15% ethanol component, E85 is a fuel that includes up to 85% fuel ethanol. The majority of motor fuel sold in the US includes no more than 10% ethanol, which is anticipated to boost demand for ethanol-powered vehicles.

The ethanol car market is divided into three categories based on blend type: E10 to E25, E25 to E85, and Above E85. In 2021, E85 had the biggest market share. Due to these manufacturers starting to produce new automobiles that might use biofuel mixes, there is a rising demand for flexible fuel vehicles. In the US, ethanol is present in the majority of gasoline. E85 for FFVs, on the other hand, has a higher ethanol content. The ethanol level of E85 varies from 51% to 85% depending on the season and the distributor's location. To provide the vapour pressure needed for starting in the chilly temperatures, E85 delivered during the winter months typically contains less ethanol.

Key Players:

1. Audi 2. Chrysler 3. Isuzu 4. Jaguar 5. John Deere 6. Mercedes 7. AB Volvo 8. BMW AG 9. Daimler AG 10. Deere & Company 11. Ford Motor Company 12. General Motors Company 13. Honda Motor Co., Ltd. 14. Mitsubishi Motors Corporation 15. Nissan Motor Corporation 16. Scania 17. Toyota Motor Corporation 18. Volkswagen AG. 19. Hero MotoCoro 20. Bajaj 21. Yamaha 22. TVS 23. Maruti Suzuki

For More Information or Query or Customization, Visit @ https://www.maximizemarketresearch.com/request-sample/183993

Drivers:

- Shifting focus from petroleum-based to alternative fuel-based vehicles.

- Increased government emphasis on ethanol-based vehicles due to environmental concerns.

Restraints:

- Fluctuating raw material and ethanol production prices.

- Increased production costs for ethanol-compatible vehicles.

Regional Insights:

- Asia Pacific expected to dominate the market.

- India's Ministry of Road Transport and Highways (MoRTH) introduces ethanol-based fuels to reduce fossil fuel consumption.

- Domestic ethanol production in India set to increase significantly.

- Vehicle manufacturers in India gearing up for E10 and E20 ethanol-based vehicles.

About Us: